Explain a Promo: Draftkings and Fanduel Placement Promos

Maximizing Value in DK & FD’s “Ties Pay in Full” Golf Bets

Let’s talk about a promo wrinkle in golf betting — one that DraftKings and FanDuel have made essential by requiring “ties pay in full” markets for many of their placement promos. These aren’t just fun extras. They completely change how we should price bets — where ties are common and dead‑heat reductions normally eat away at your edge. If you’re still using models that assume standard payout rules, you’re underestimating your EV.

Dead Heat Reduction: The Standard Trap

In a typical placement bet (Top 10, Top 20, etc.), if your golfer ties for the last qualifying spot, most books apply a dead‑heat reduction. Your stake is divided by the number of players tying.

Example: Four players tie for 10th, you’re on one of them — you only get ¼ of the payout.

Over many bets, those sliced‑and‑diced payouts can turn a +EV angle into a breakeven slog.

Promo Shift: “Ties Pay in Full”

DraftKings and FanDuel have flipped the script. They now offer placement markets labeled “Including Ties” or “Ties Pay in Full,” where dead‑heat reductions don’t apply. Tie for 10th? You get the full payout.

When these promos are live, you must bet into those full‑payout markets to qualify — so understanding how to reprice them is critical.

The Catch: Your Model Isn’t Built for This

Neither DataGolf nor Circa prices to “ties pay in full.” Their projections assume standard dead‑heat rules, which chop payouts on ties. If you use their numbers unadjusted, you’ll:

Undervalue +EV bets

Pass on spots that are actually profitable once ties pay full

How Much Adjustment Is Needed?

Let’s walk through a basic Top 20 example, now using a more realistic 2.5‑player average tie‑group instead of a flat 3‑way:

Standard fair odds: 1 / 0.102 − 1 ≈ +880

Promo fair odds: 1 / 0.120 − 1 ≈ +733

Your back‑of‑napkin move from +880 to +733 is right in the sweet spot.

Refined “Cheat Codes”

Tie frequency varies by cut, so here’s a rule‑of‑thumb based on the 2.5‑player divisor:

Top 5: very few ties → ~0.5–1% absolute EV bump → 3–5% odds adjustment

Top 10: more ties → ~1–1.5% bump → 5–7% adjustment

Top 20: even more ties → ~1.5–2% bump → 8–10% adjustment

Remember: these bands anchor you in the right ballpark, but you can always tweak with historical tie data.

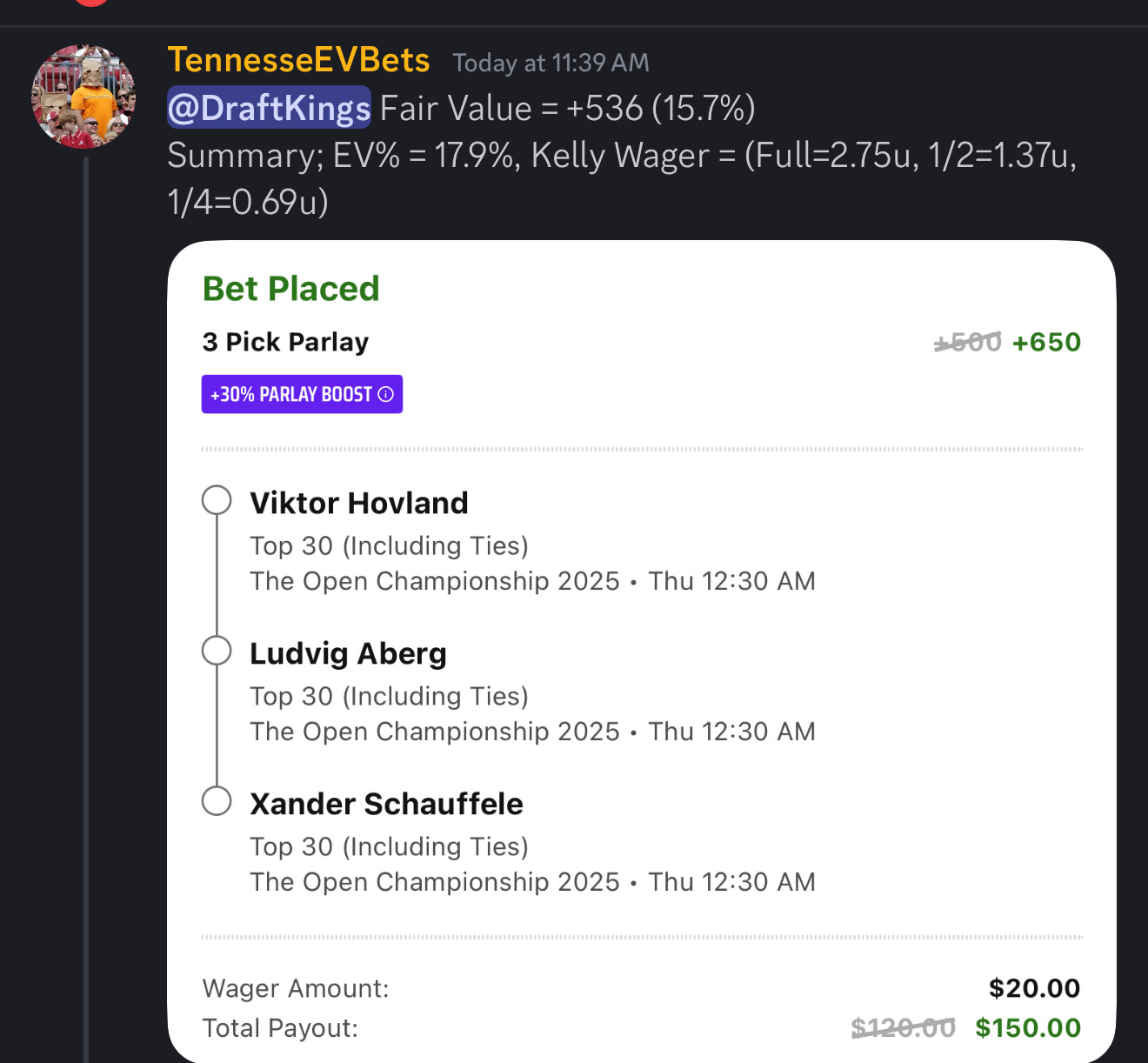

Real Bets I Made

Here are two examples I released on Linesnipers, showing exactly how I’ve been attacking these:

Once you reprice for “ties pay in full,” these spots jump from meh to +EV.

Strategy Summary

Build two pricings in your model:

Standard (dead‑heat) vs. Promo (ties full)

The difference = promo edge

Target T10/T20 markets where ties cluster most.

Use 365/MGM for context but beware higher juice.

Track outcomes over time and refine your divisor.

These edges may not leap off the page every single week, but once you reprice correctly, they become a steady source of +EV. In golf betting, that’s the long game we’re all trying to win.